Every journey starts somewhere. So here are the numbers, that I have to work with.

An important note for you:

I’m calculating for a two person household, since I’m married to a beautiful woman. Bear this in mind if you compare this numbers to my brother’s.

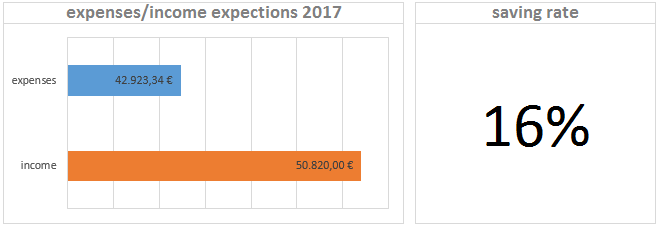

I have to admit, that I’m not really proud of my saving rate, but at least it’s something. I already minimized all expenses to a low level, but my wife and I decided, that we want to have a beautiful life. That means we want to feel cozy in our own home, do vacations in 5-star hotels, eat healthy (which really costs a bit more) and give ourselves a little bit of pocket money for our hobbys. I’m a cyclist and maybe some of you know, that this can be fairly expensive 🙂 For that purpose everyone of us gets 300 Euro per month.

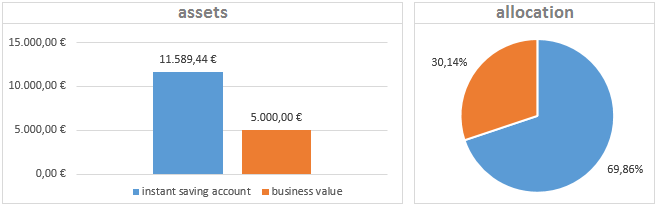

So we come to the assets. As you see: straight focused.

For emergency situtations you should always have round about 5 times your monthly expenses as liquid money on hold. For us, this is round about 12.000 Euro.

The rest went as starting capital into my own business. Growing one is hard work, where you have to focus your workforces and that’s why there are no more assets. When my video production company is up and running, I will spread the risk and invest in real estates.

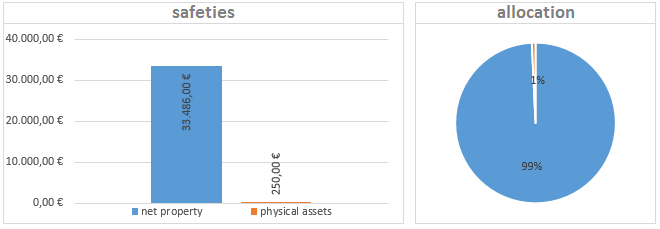

Speaking of real estates, we already bought one on credit. Buying price was 200.000 Euro and we pump a big chunk of our money – round about 13.000 Euro – every year into that credit. With the increase in value, the net-worth for this real estate is now already 33.486 Euro. Maybe some of you will scream now: “But this is an asset. Why don’t you clarify it as such?” Because – in fact – it isn’t an asset when you live in there for yourself. It costs me money at the moment, so it’s a liability. Only when I get money out of it, it’s an asset.

The really thin line besides the big blue block stands for an investment in silver. We got some as a present to our wedding, which is now worth round about 250 Euro. And I must say, that I really like this idea. If World War 3 is coming and inflation rises to the top, silver will be far more worth than now. I think this will be enough to hold two persons alive for a good amount of time.

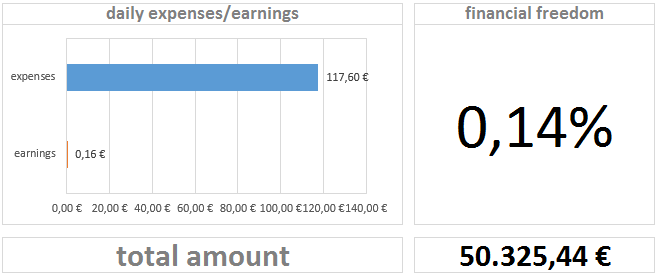

In conclusion I’m basically at zero here. The 0,16 Euro I make a day is the interest on our savings account.

The total fortune, was also a surprise for me, since I calculated this today for the first time. Would be interesting to know, if some of you know the number for yourself. Let me know, in the comments below 🙂

My targets for 2017 are the following:

- savings account should be at around 16.000 Euro

- our real estate net-worth should hopefully increase to round about 50.000 Euro

- and I will increase the worth of my video business to 10.000 Euro.

Stay tuned, because next week I will deliver the first numbers from my business 🙂

Great blog man! What’re your thoughts on silver vs gold?

LikeLiked by 1 person

Well, I think it’s good to have some for the apocalypse

LikeLike

One is better than the other? Or the same preference for either?

LikeLiked by 2 people

For me, it’s the same. Maybe silver slightly up, since you don’t have to declare it in your taxes 😉

LikeLike

What’s your thought on this?

LikeLike

I don’t personally have much holdings in physicals, but I am looking into it. At least for Canada and US, silver is taxed as gold is, platinum, diamonds, etc. Which country are you living that has this tax break?

I have explored more in ETFs or index of precious metals though.

Any other tips for bullion?

LikeLiked by 2 people

My colleague Max could help you out there. He is totally into ETF’s. Im livin in Germany 😉

LikeLiked by 1 person

😉

LikeLike